There are many ways and methods to carry out fundamental analysis on a listed company.

The important and common data will be:

1. Profit earning ratio (PER)

2. Net tangible asset per share (NTA)

3. Dividend yield (DY)

Besides, it is also important to know some qualitative infomation:

1. Management of the company

2. Future development/plan

3. Related market/sector

*Editing in progress

Happy investing!

Be an expert in building your wealth. Learn everything about money in Malaysia. 投资与理财的资料库

March 1, 2017

February 28, 2017

Tax Rate

Let's learn something about income tax. Below show the income tax rate for assessment year 2016:

Source from: http://www.hasil.gov.my/bt_goindex.php?bt_kump=5&bt_skum=1&bt_posi=2&bt_unit=5000&bt_sequ=11

How should we analyse this table? Actually we can see them by section. Check the following table:

What does it mean? The first RM 5,000 that you earned (chargeable income) that year will be tax free! After that, the next RM 15,000 that you earned, each ringgit will be charged with 1% tax. Following that, the next RM 15,000 again you will be charged with 5% tax and so on.

Say you have a chargeable annual income of RM 36,000 that assessment year. The first RM 5,000 is tax free, next RM 15,000 is 1%, next RM 15,000 is 5%, and the final RM 1,000 is 10%, giving a total of RM 1,000 that you have to pay for income tax.

Do check out what item can deduct your chargeable income, as after you jump to another tax bracket, each extra ringgit is going to be charged with higher tax rate. As the scenario above, the first RM 35,000 is only charged with RM 900 tax but the final RM 1,000 alone you are paying RM 100 tax. It is up to you to keep the RM 900 and pay the RM 100 tax; OR you can use that RM 1,000 fully on tax relief items and do not need to pay that RM 100 tax.

The tax relief can be seen as an initiative for the government to promote spending on certain area/sector. Do use it wisely to maximise your gain on monetary or non-monetary portion. However, do keep a nice filing for all the receipts for the tax relief items as you could be penalised for not able to show proof when they do auditing on your tax submission.

Be smart with your money. ^_^

Bursa Malaysia Trading Session

Just to share some information about Bursa Malaysia.

Below is the trading session and phases for normal trading days:

Source from: http://www.bursamalaysia.com/market/securities/equities/trading/trading-sessions/

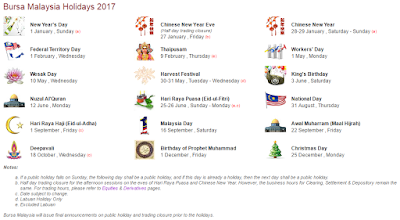

Do take note that except Saturday and Sunday, Bursa Malaysia also does not trade at the following holidays:

Source from: http://www.bursamalaysia.com/corporate/about-us/holidays/

Happy investing!

February 26, 2017

Potential Return vs Potential Risk

For an investment, return is always proportional to the risk. The higher the profit is, the higher the risk it could incur. However, with careful study and detailed analysis, you could minimize the risk you are facing when deciding to invest into an opportunity.

From Securities Commission Malaysia, the list below shows the type of investment you can involve in legally to obtain earning from the fund invested. The lower is the position of the item in the list, the higher potential you can earn a great profit, however, it also comes with higher risk.

1. Saving account

2. Fixed deposit

3. Money market

4. Government bonds

5. Corporate bonds

6. Bond unit trust

7. REIT

8. Balanced unit trust

9. Real estate

10. Dividend shares

11. Equity unit trust

12. Foreign currencies

13. Shares

14. Future and options

The return and risk of each investment is affected by many internal and external factors. Hence, you can never predict precisely the outcome of certain investment, especially for high risk investment.

Happy investing!

From Securities Commission Malaysia, the list below shows the type of investment you can involve in legally to obtain earning from the fund invested. The lower is the position of the item in the list, the higher potential you can earn a great profit, however, it also comes with higher risk.

1. Saving account

2. Fixed deposit

3. Money market

4. Government bonds

5. Corporate bonds

6. Bond unit trust

7. REIT

8. Balanced unit trust

9. Real estate

10. Dividend shares

11. Equity unit trust

12. Foreign currencies

13. Shares

14. Future and options

The return and risk of each investment is affected by many internal and external factors. Hence, you can never predict precisely the outcome of certain investment, especially for high risk investment.

Happy investing!

February 23, 2017

Fundamental vs Technical Analysis 基本面?技术面?

Fundamental (基本面) and technical (技术面), 哪个比较重要?这个问题见仁见智。其实,两个都重要。

基本面分析主要是研究公司表现、业绩、管理层、现金流、成长、股息等等。而技术面主要针对股市投资者的心理做推测。有人说基本面比较适合长期投资;技术面则偏向于短线操作。其实,至根据基本面做投资的话,可能会错失很多获利机会。而只专注技术面做出投资决定的话,风险是极高的。

长期来说股价会反应其基本面价值。但是从被低估价值守到股市释放其价值,通常要等利好消息,交投开始活跃,成交量上升以后。这段等待时期会发生什么变化,很难去做猜测。但只要公司基本面够强,地基够稳,没有什么特别造成亏损的事件,股价就会平稳。

另一方面,技术面投资没有基本面支撑的话,是非常危险的。技术面如果运用得当,可以将投资利润最大化。但是,如果一昧追高股价到超过其实质价格,其实是有一定风险的。这其实有点像赌博:看谁得以在高点卖出,剩下的则被套牢。

回顾2008年股灾,当投机者过多,股市不稳,极容易造成泡沫破裂。基本面不好的公司通常会被先淘汰,而投机者也因手上股票变废纸而血本无归,损失惨重。

投资股票等于做公司的股东。公司资本增加,提高生产力,业绩进步,公司价值提高,自然反应其上升股价。反之,股价不断被推高,但公司表现平平或下滑,总有一天股价会被大户套利出场而大势败退。无法全身而退者则长期套牢或忍痛亏损了解。

何者更适合你的投资策略,自行评估。

February 20, 2017

Maybank FD/IFD-i CNY Campaingn (10 months)

Maybank launches Maybank FD/IFD-i CNY Campaingn (10 months) before chinese new year.

Feature

|

Detail

|

|---|---|

| Commencing date | 23rd Jan 2017 to 28th Feb 2017 |

| Tenure | 10 months |

| Effective rate | 3.91% p.a. |

| Method of placement | Over the counter |

| Restriction | Fresh fund |

| Minimum placement | RM 10,000 for individual, RM 25,000 for business |

| Maximum placement | RM 15 mil for individual, RM 20 mil for business |

Scenario of placing RM 10,000 into the campaign over 10 months:

February 19, 2017

Malaysia FD Rates Update from Investalk Forum

Quite some useful information can be obtained from this forum : Investalk.com (content mostly in chinese). A forum user has provided information update about most of the fixed deposits from Malaysia banks. The page can be viewed here.

The fixed deposits include normal FD (which needs to deposit over the counter), e-FD (can be placed online) and other promotion offered by the banks from time to time.

Hope everyone can contribute and share the information to keep us updated with any change in FD rates or promotion launched by the banks.

Happy investing and learning more about your money. Be someone who is good in both health and wealth! :)

The fixed deposits include normal FD (which needs to deposit over the counter), e-FD (can be placed online) and other promotion offered by the banks from time to time.

Hope everyone can contribute and share the information to keep us updated with any change in FD rates or promotion launched by the banks.

Happy investing and learning more about your money. Be someone who is good in both health and wealth! :)

KWSP Dividend 2016

KWSP just announced the dividend for financial year 2016 on 18th February 2017. The nominal dividend declared is 5.70%, the news can be read from their website.

February 3, 2017

Maybank FD Rates

Before we start investing our money for better returns, we must also keep some money in a safe place for emergency use. When there is a crisis, those money will also be a good fund to find the golden investment opportunity in the market. One of the safest place with relatively not so low return will be fixed deposits.

Here is the rates for main fixed deposit offered by Maybank:

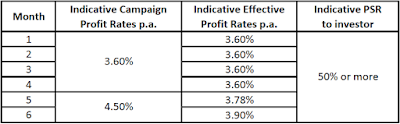

Besides that, Maybank does offer some special financial products which give a slightly better rate. For examples, Maybank launches General Investment Account-i (GIA-i) Campaign from 16th Oct 2016 to 15th Feb 2017. This the rate for 12-months campaign:

This is the rate for 6 months campaign:

The best feature for this product I would say is it pays out the interest monthly! The downside would be unlike fixed deposits, it does not covered by PIDM. However, due to overwhelming response, the fund reaches its maximum quota and will not receive new placement anymore not long after the campaign started.

Do keep an eye on each bank's website for their promotion. Sometimes there will be good deals to consider. Putting money in current or saving accounts hardly earn you any interest and your money will definitely outrun big time with the inflation. Be wise and learn how you can put your money in better and better place.

February 2, 2017

Standard Chartered Gold CashBack Master Card

Standard Chartered offers Gold CashBack MasterCard which promoting up to 5% cashback per month for your retail spends. Here is the summary from iMoney.

| Minimum retail spend | Cashback % | Cash Back Cap | Eligible retail spend to reach the cap |

|---|---|---|---|

| RM 500 | 2 % | RM 10 | RM 500 |

| RM 800 | 3 % | RM 25 | RM 833 |

| RM 1,500 | 5 % | RM 50 | RM 1,000 |

The cash back is calculated based on all transaction except:

1. Insurance

2. Transactions made at petrol station/kiosk

Analysis

Similar to the Standard Chartered JustOne Platinum, this card also come with minimum spend and cash back cap.

As you can see from the graph, if you consider the rebate based on your total spending on the card, the effective rebate does differ a bit from original rates. It peak at 3.33% when you spend RM 1,500 in the billing month with at least RM 1,000 of eligible spending. After that point, the more you spend, the less effective rebate rate you will get.

Conclusion

If you are spending between RM 500 to RM 3,000 per month via credit card, you can enjoy a rebate rate of about 1.5 % to 3.3%. This can be a good card, from the perspective that it only restrict you from earning cashback via insurance payment and petrol station purchases. Do take note that there is an annual fee of RM 185.50. If this annual fee can be waived, you can earn up to RM 600 rebate per year with minimum RM 18,000 eligible spend on the card.

February 1, 2017

Calculating Interest on Fixed Deposit

This might not be a big deal but it is always good to know how the system works.

Have you ever wonder why although you put in an exact amount of money into a fixed deposit (FD) account, but you receive not exactly the same interest every month?

This is simply because most of the FDs calculate interest payment based on number of days the money is in the account, not number of months.

For example, say you have a FD of RM 10,000 put on 1st Jan 2017 with 3% annual rate and monthly maturity time. By 1st Feb 2017, you will receive RM 10,000 × 3% × 31 days ÷ 365 days = RM 25.48 interest.

Say if you continue to maintain the amount of RM 10,000 in that account. By 1st Mar 2017, you will then receive RM 10,000 × 3% × 28 days ÷ 365 days = RM 23.01 interest. This is the reason why every month the bank will give out interest of different amount.

Take note that if it is the leap year (ie year 2020), then the denominator shall be 366 days instead of 365 days.

Just sharing, or just to show you that the banks do not cheat you with the rates declared, haha. :)

January 31, 2017

Citi Cash Back Credit Card (Old)

*This is outdated, the latest one can be referred here.

Citibank provides Citi Cash Back Credit Card with three main features highlighted:

1. Up to 5% cash back on everyday purchase

2. No minimum spend required

3. Automatic cash back into your account once you accumulate a minimum of RM 20 cash back

You can view the summary from iMoney.my about Cash Back Card and Cash Back Platinum.

| Rebate | Category | Cap for Cash Back Normal | Cap for Cash Back Platinum |

|---|---|---|---|

| 5% | Petrol | RM 15 | RM 20 |

| 2% | Pharmaceutical | - | - |

| 2% | Grocery | RM 30 | RM 60 |

| 2% | Telco | - | - |

| 0.2% | Other retail spend | - | - |

Pharmaceutical includes spending in Guardian, Watson and Caring pharmacies.

Grocery includes spending on groceries at AEON Big, Tesco, COld Storage, Giant, Everise, Servay, Econsave and Mydin.

Telco include bill payments to Maxis and Digi, excluding JomPAY transactions.

Take note that certain transactions are not eligible for cash rebates, which includes:

1. refunded, disputed, unauthorized or fraudulent retail transactions

2. catering and out-call food and beverage services

3. child care services

4. special events/categories (including funeral and crematoria services, clothing rental, photographic or video-graphic studios and florists)

A rather simple rebate system with no minimum spending required! That is the part I like the most.

A 5% rebate on petrol is relatively good (although there are some cards with even higher rebate rate on petrol), There are also 2% rebate on spending in pharmaceutical, grocery and telco outlets.

Do take note you will once receive the cashback on the first day of the billing month after you achieve a minimum rebate amount of RM 20.

Conclusion

Generally quite a good cashback card. Theoretically, say you have a normal cashback card, if you spend exactly RM 300 on petrol and RM 250 on the other three categories (with 2% rebate), you can receive RM 20 cashback every month which is effectively 3.64% rebate. Or you can enjoy RM 30 rebate every two month (ie 5% monthly rebate) if you only spend on petrol (RM 300 monthly).

January 27, 2017

Standard Chartered JustOne Platinum MasterCard

Standard Chartered launches

the JustOne Platinum MasterCard

promoting up to 15% monthly cashback. According to their website, you can get more than RM1,000 cashback a year on all your daily spends and receive exclusive deals with the all-new JustOne Platinum MasterCard credit card.

| Retail Spend per Month (RM) | Auto Bill Payments, Online Purchases & Petrol | Other Categories | Cashback Cap (RM) |

|---|---|---|---|

| Below 1,000 | 0.20% | 0.20% | 12 |

| 1,000 - 1,499.99 | 5% | 0.20% | 12 |

| 1,500 - 2,499.99 | 10% | 0.20% | 28 |

| 2,500 & above | 15% | 0.20% | 85 |

On top of the rebate through monthly retail spend, you can enjoy an additional RM300 cashback when first applying the card via two actions:

1. Activating the card within 45 days from card approval date will receive RM150 cashback.

2. Signing up and performing 5 or more auto bill transactions within first 90 days from card approval date will receive up to RM150 cashback.

| No of auto bill transactions | Cashback [RM] |

|---|---|

| 1-2 | 50 |

| 3-4 | 100 |

| 5 and above | 150 |

These auto bill transactions can be from utilities (Astro, Indah Water and TNB), Telco (Celcom, Dlgi, etc almost all telco companies) and Insurance (Great Eastern, Manulife, Prudential, etc almost all big insurance companies). The list of billers eligible can be viewed here.

In addition, there are some merchant offers:

1. Sakae Sushi : 1-for-1 hand roll and blue plate (valid until 30th June 2017, valid with dine in only with maximum free 2 plates each per transaction, per table. Not valid on public holidays.)

2. Golden Screen Cinemas : RM 7 per ticket for any movies via GSC website and mobile app (valid till 28th February 2017)

3. Uber : 20% cashback on fares globally for 12 months (valid 1st Oct 2016 to 30th Sept 2017, subject to minimum spend of RM750, eligible for cards issued in Malaysia only)

Analysis:

Do take note that the high rebate percentage is only for spending in 3 categories: auto bill payment, online purchases and petrol. At the first glance, it might seem like a very good deal with 15% cashback. However, be aware of this: the cashback calculation comes with minimum spend as well as cashback cap. With this, the rebate may not seem as high as 15% or even 10% if you calculate based on the total amount spent on the card. For example, a RM 1500 monthly spending is entitled for 10% rebate which should be RM 150. However, the cap is set at RM 28 and thus this is the maximum you can get. If we factor in the monthly cap and minimum spending, the effective rebate percentage based on the formula below and is shown in the graph:

As you can see from the graph, the maximum rebate you can get is effectively 3.4%. That is, if you spend exactly RM 2,500 every month using the card (with at least RM 566.67 spent in the three eligible categories), then you will receive a total annual rebate of RM 85 × 12 = RM 1020. This is the maximum amount of rebate you are eligible to get every year. To achieve this 3.4%, you need to spend RM 2,500 × 12 = RM 30,000 in a year.

RM 150 cashback from activating the card within 45 days should be quite an easy job. On the other hand, to obtain the other RM 150 cashback, you do need to use some efforts to change most of your auto bill payment under this card, say your phone post paid plan, electricity bill, broadband plan, Astro, insurance and Indah Water bill.

Offers for Sakae Sushi, GSC and Uber are not bad as long as you fulfill all the conditions.

Conclusion:

Personally do not really like the card. Mostly because I don't spend that much on auto bill and online purchases and there are a lot of great petrol rebate cards in the market. Nevertheless, it does offer relatively high rebate for spending on online purchases and auto bill payment, unlike most of the credit cards which only offer 0.2% in these categories. Hence if you do spend that much using credit card and most of the spending are in these three categories, this card does provide you about 1 to 3% rebate effectively.

January 26, 2017

First Post

Financial planning is essential for us to enjoy our life when we retired. This involves controlling and managing your income and also spending. Insurance is also important so that when an unexpected and undesirable event occur, it will have lesser impact to our life as well as financial plan.

Investment is the key to increase our passive income and achieve financial freedom. However, ones must always do homework before putting money into any investment products (unit trust, stock, real estate, etc). If you blindly follow any "expert's advises", then good luck. Never invest into what you don't understand or you won't even know why investment makes you poorer.

Please get yourself far from any scam/ money games that promise you high return with no risk. Remember: Risk is always proportional to return of an investment. Those "investment" with ridiculously high return are bubbles with no one monitoring and regulating its growth. It could burst anytime.

Happy investing and learning more about your money. Be someone who is good in both health and wealth! :)

Subscribe to:

Comments (Atom)